An eye to the US elections

In just under two months, on 20 January 2017, Donald Trump will become the 45th President of the United States of America. The Republican Party now hold the majority in the US Senate and the House of Representatives, giving them control of Congress. With Republicans now controlling 37 of the 49 state legislatures, Trump has been touted as one of the most ‘powerful’ US presidents since the 1920’s.

Upon news of his election the market initially reflected a kneejerk negative response, similar to what we saw following the Brexit vote a few months ago. In fact it’s a pattern that is starting to emerge more broadly from the US to the UK, with potential populist swings in Italy, Germany and France the next key political moments to watch. While the impact that these will have on the Euro is important to consider, it is unlikely that such events would come as such as ‘shock’ to the markets again.

It is at times like these that the value of our investment philosophy and strategy are most evident. Strategic scenario planning and our tactical asset allocation model are designed for exactly such market turbulence, to mitigate risk and to anticipate ‘unexpected’ outcomes such as these.

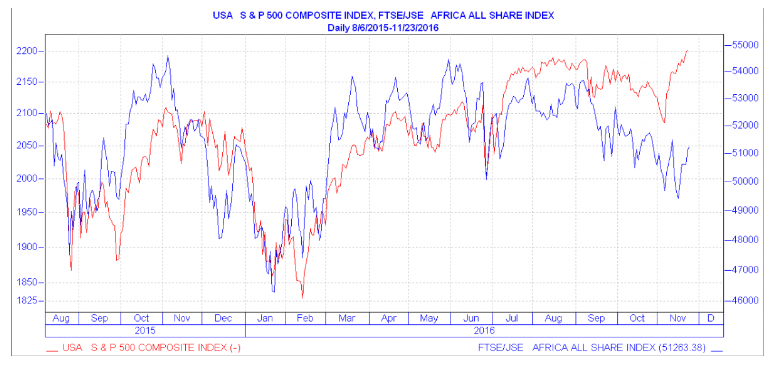

The US Equity Market Surprises on the Upside

As with the Brexit, following an initial slump, the markets eased as investors focused on Trump’s proposed tax cuts, a pushback on market regulation and extensive infrastructure spending proposals.

One of the primary reasons for the market’s initial negative response was that Trump is somewhat of an unknown political entity. While he has campaigned on the basis of making significant changes to US society and the economy, it is equally important to note that many of his most aired campaign promises are simply unfeasible. As such, although he can propose new legislation, he will have to get approval from Congress - an inherently conservative institution - before implementing these. Even within his own party, Trump would face significant pushback on a number of his more controversial positions. That, and the strength of the US constitution and political system, serve as controls on his presidential power.

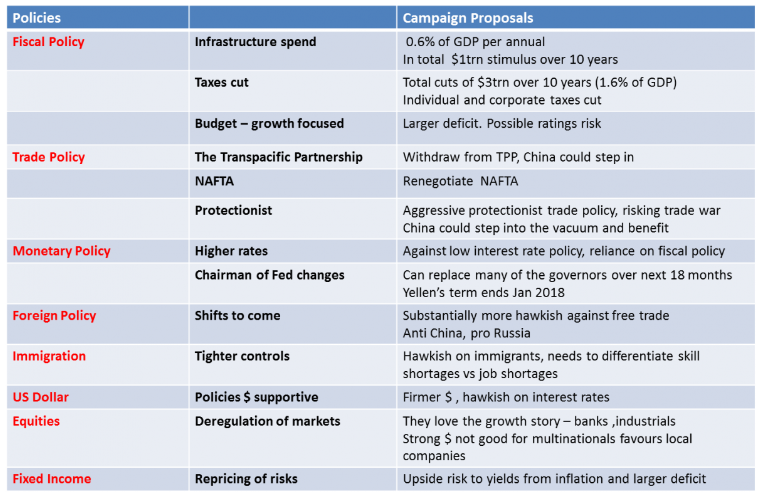

Summary of Trump's Proposed Policies

On the fiscal front, he has proposed increasing government expenditure on the military and, even more so, on much needed infrastructure. This will equate to $1 trillion over 10 years. Individual’s taxes will be cut through reducing the tax bands while corporate taxes will be cut from 35% to 15%.

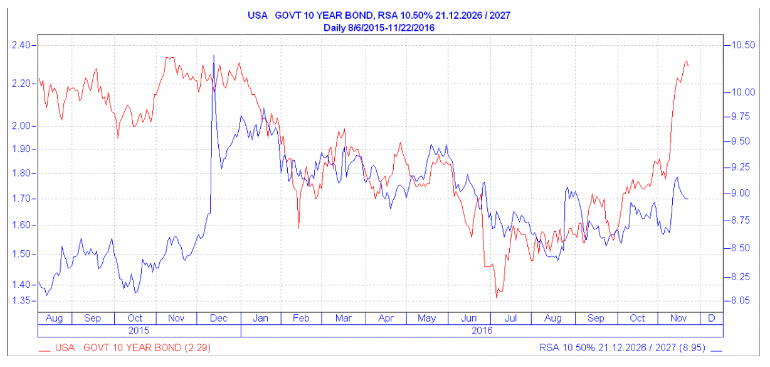

While potentially boosting economic growth, these proposals have changed base case expectations from deflation to inflation and from a shrinking to a widening budget deficit. Reflecting this, the yield on the 10-year US bond, jumped to 2.35% up from 1.80% prior to the election. This was the biggest jump since 2013 and could rise further as expectations of a widening budget deficit and increasing inflation pressures grows.

US Bonds Jump in Reaction to Trump's Election

In line with his election promise of bringing jobs back to the US, how Trump’s more protectionist trade policies and handling of international trade partnerships such as the North American Free Trade Agreement (NAFTA) and withdrawal from the Transpacific Partnership (TPP) play out will be important to watch.

While such events could have an impact on South Africa, given that more than 50% of our GDP is either imported or exported, it is equally important to note that trade partnerships cannot be abolished unilaterally. While the concern is that a Trump–initiated trade war could ultimately put downward pressure on global growth as tariffs jump and trade slows, it is simply too soon to tell what Trump’s effect on trade may be. Interestingly, China could step into this void by bringing in their own Asia Pacific trade agreements.

Another area to watch will be the Federal Reserve, as it is unlikely that current Chair Janet Yellen will be reappointed at the end of 2018. Trump has opined that the Fed has created a false stock market and is very political. Given his more hawkish stance on monetary policy, he is likely to nominate a more 'hawkish' Chairman in 2018, and has the opportunity to replace 5 of the 7 incumbent governors of the Federal Reserve Open Market Committee (FROMC) over the next 18 months.

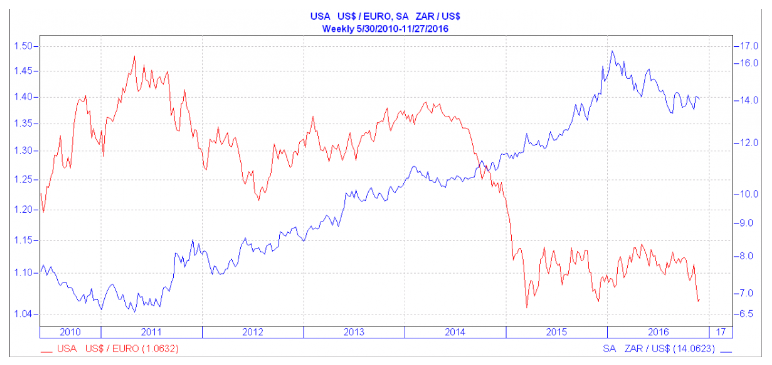

Despite these potential changes, the Fed has made it clear that it is business as usual; the long-awaited rate hike is still set for December. The surprisingly positive market reaction and firm economic data are all supportive thereof. This, together with a big jump in bond yields, has strengthened the Dollar by 8%, putting pressure on all currencies including the Rand. The Dollar is expected to remain strong given the improved growth outlook and more hawkish interest rate cycle now expected.

Dollar to Remain Strong

What this means for the positioning of our funds

Nearing the end of what has been an eventful year - from Nenegate to Brexit, South Africa’s potential debt downgrade to Trump’s election win – as always, we remain focused on the long-term objectives of our well-diversified funds. As with any shock to the market, and as we’ve seen so far this year, unexploited investment opportunities are sure to soon materialise, and we will look to maximise on these. The recent rise in political uncertainty in developed markets, and the extent to which this has been underpriced, could even bode in South Africa’s favour as emerging markets strengthen in response.

Time and again, this year, the value of our tactical asset allocation model and investment philosophy has evidenced itself. Our funds remain cautious, as they have been in anticipation of such ‘shocks’, and we continue to concentrate on constructing well-diversified portfolios with an eye to capital preservation and growth over the long-term. In line with this, we continue to favour the equity and property sectors, which provide inflation beating returns over the long-term, while having a healthy exposure to fixed interest assets to protect on the downside.

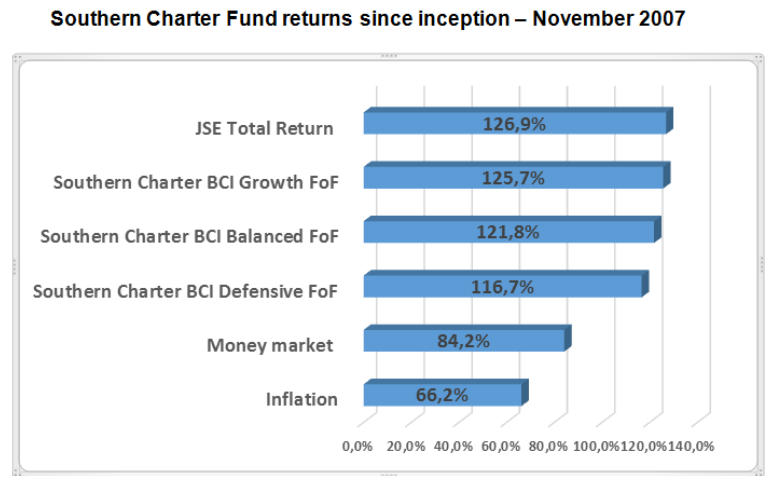

As our performance over the last eight years attests, most notably through far greater market uncertainty than we face today, our investment strategy is well-balanced and resilient to various market outcomes. While Trump’s presidency may have somewhat surprised the markets, and global popular opinion, our investment strategy and outlook remain unchanged.

Southern Charter Fund Returns Since Inception - November 2007