An Inward Looking World

2016 is coming to be defined by a rising wave of populism around the world, most notably in the recent outcomes of the US presidential election and June’s Brexit referendum.

Most immediately this can be seen as a response to the rapid - and somewhat unregulated and unrestrained - rise of globalisation and unprecedented growth that has defined the last decade. As world-renowned Geopolitical Strategist Peter Zeihan among others predicted, we’re moving towards a more inward looking world.

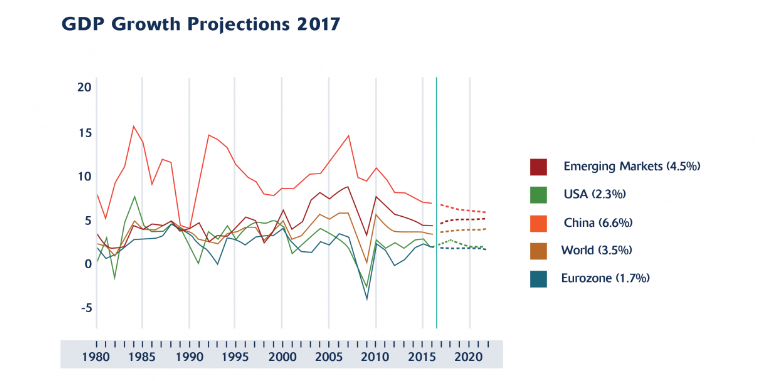

Understandably, this could signal a period of significant change for global markets, trade and investment as international economies slow. As the US election and Brexit referendum evidence, while globalisation has held many benefits these have largely been concentrated near the top. Rapid global growth, the ‘offshoring’ of industries and manufacturing, and a largely unregulated global workforce have also produced some significant losses, and it is this pushback that is now becoming increasingly prominent. The most significant beneficiaries of globalisation have been the holders of capital. Labour has ‘lost’.

The rise in populism and a more nationalist rhetoric is reflective of such a populace that has grown increasingly disenfranchised and is feeling increasingly vulnerable. As jobs are lost to overseas countries with less stringent labour laws, and expatriate and migrant workers play increasing roles in foreign economies, we have seen a shift towards a more ‘walled in’ stance and sentiment internationally.

This has been a particularly prominent definer of our recovery economy post-2008 as those hardest hit by the financial crisis still grapple with its effects, and have failed to find their governments 'working for them'. As the risk of similar inwardly looking outcomes in Germany, France and Italy heightens, this impact on the Euro is one of the crucial aspects to watch in the coming months. Most particularly, a fundamental focus should be placed on candidates' stance on interest rates. Macro-economic strategies are growing increasingly important in this more self-interested world, and how newly elected governments plan to unwind the influence of central banks will be a definining feature.

While perhaps some may see this more inward looking shift as a regression, it was also perhaps to a degree inevitable, as would be an eventual shift back to a more moderate middle ground, perhaps even a ‘fairer world’.

While since the Cold War global politics and economics has largely been defined by the military-backed promotion of free trade, today the most significant pressures exerted on governments are internal. Nationalism, labour and self-interest are redefining the geopolitical sphere and world markets. The same pressures that are self-evident in South Africa at the moment in the wake of Fees Must Fall protests, tensions between the ANC and COSATU, and increasingly nationalist rhetoric.

If we play our cards well, however, our youth places us in a strong position. As the Western world ages what the McKinsey Global Insitute has dubbed the ‘Lions of Africa’ are only just entering into their earning potential. The crucial aspects in this regard will be to resolve the education crisis with haste, to create more jobs, and thereby to give our population more purchasing power.

While a more inward looking world may signal a general slowdown in global trade, South Africa could still benefit. As largescale trading blocks break up, South Africa could be well-positioned to renegotiate more benefical individual trade partnerships with UK, the US and other Eurozone countries.

Over and above trade opportunities, however, it is time South Africa entered into our service-based economy prioritising our people, our natural beauty, and all of the South African wonders that aren’t subject to export. An aging Western world means the value of experiences and of travel are sure to grow and we’re incredibly well-positioned to take advantage of that.

While the world undergoes a shift in geopolitics and our global economies, and uncertainties as to exactly what this 'new world' will look like abound, it is also always at such moments of redefinition that opportunities present themselves.