Commodities - where to now?

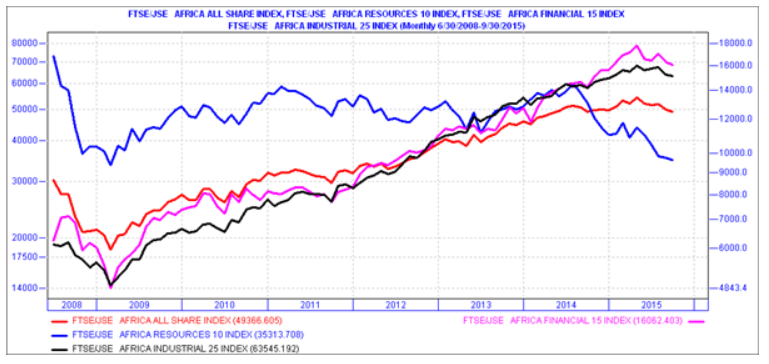

Despite the pullback, large cap industrials are still at high levels of valuations and so a lot of focus remains on the resource sector given their relative attractive valuation levels.

In addition, resources have now been in a bear market since early 2014. This has triggered a lot of debate as to whether one should add to existing holdings in our portfolios, add later, or keep the status quo.

Resource sector still under pressure

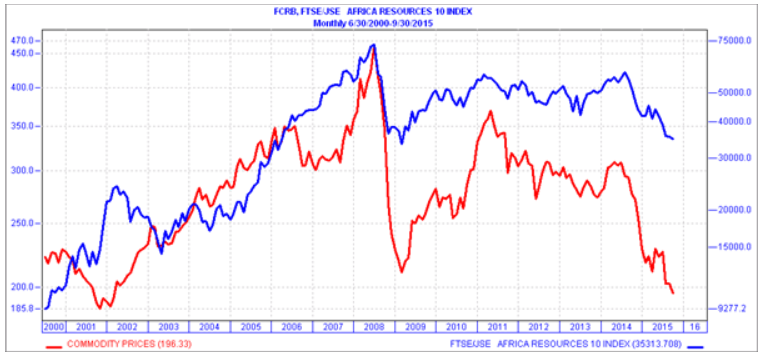

The answer really lies in identifying the catalyst that will push commodity prices out of their five year slumber and trigger a repeat of the six year bull market which ended in 2008. Without a catalyst to unlock value, returns will not be forthcoming despite low valuations. Low valuations do not automatically translate into immediate returns but can take time to materialise. In addition, as the recent market pullback has demonstrated, low valuations don’t necessarily provide protection in a risk–off market either.

Commodity prices have provided little support to the resource sector

Global growth, particularly Chinese growth, is a key driver of commodity demand as China accounts for 40-50% of global industrial commodity demand. This driver has come under increased scrutiny recently as data emerging from China points to weaker growth than expected. The PMI is at a six year low of 47.1 confirming the ongoing contraction in the manufacturing sector. Other indicators, such as weak electricity demand and steel production, also confirm this.

Although Chinese policy-makers have recently cut interest rates, devalued the Yuan, and have instituted other fiscal policy measures, the shift in growth away from infrastructure continues to weigh heavily on commodity prices. As Chinese growth hovers close to 6.5%, and given the change in the pattern of growth, a repeat of the Chinese commodity demand seen in mid- 2000 is unlikely.

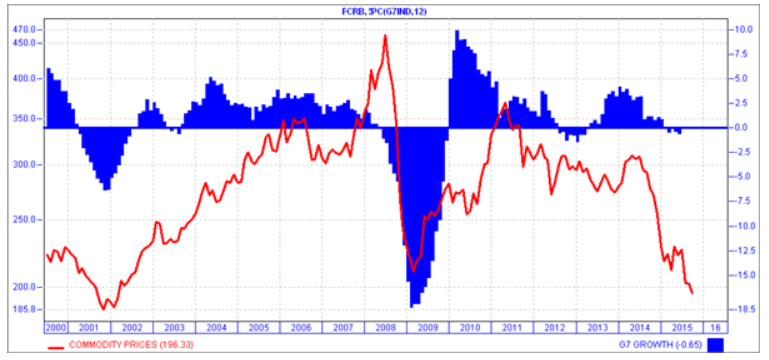

Global growth not yet supportive of commodity prices

Turning to growth elsewhere.

Yes, US growth is picking up and reached 3.7% in the second quarter, however this, together with firmer growth elsewhere (1.5% in Eurozone and 1.2% in Japan), will only result in global growth of around 3.4% for 2015 and 3.8% in 2016. This is not enough to offset lacklustre Chinese demand.

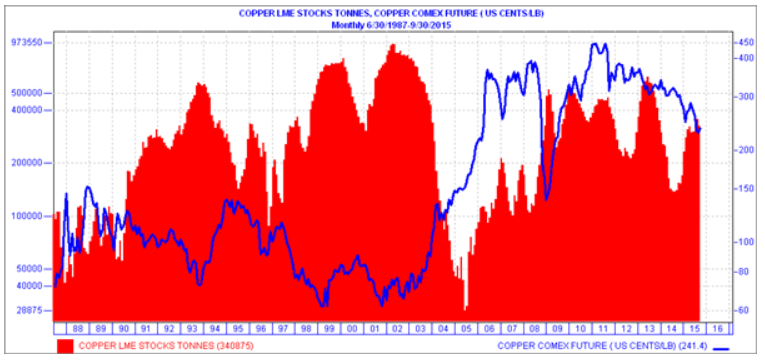

The supply side of the equation is also not positive as a lot of supply has come onto the markets from projects started at the peak of the last commodity cycle. As a result there is very little tension in the supply-demand equation, unlike in 2002-2005, to drive prices up. In fact, stock levels across most base metals are still high with copper being a case in point.

Copper stock levels still high

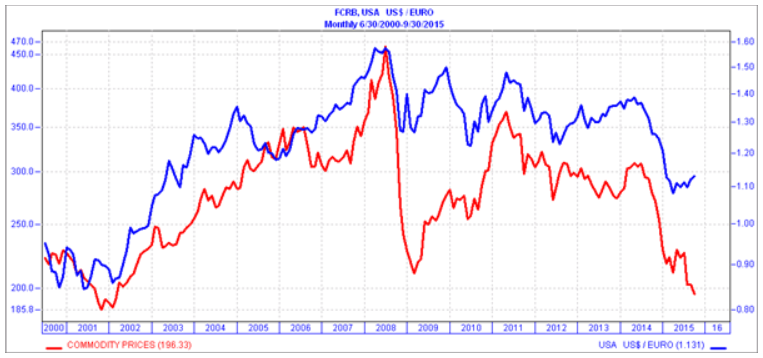

The expected Fed tightening is also buffeting commodity prices as the dollar has strengthened and will remain strong as interest differentials widen in line with monetary policies that reflect differing growth paths.

The Fed is expected to increase rates gradually while the ECB, BOJ and PBOC (People’s Bank of China) will maintain or ease policy. Historically, a strong Dollar is not positive for commodity prices and this could prevail for some time.

A strong dollar is not good for commodity prices

Precious metals, like gold, are not only at risk from a strong Dollar but also from the increased risk of deflation in economies like Europe. The role of gold as an inflation hedge is certainly not being supported in the prevailing environment where the average inflation rate is below 0.5% across most developed economies.

Other commodities under pressure are oil and maize, whose prices have fallen by 58% and 52% respectively in the last year. Both have a big impact on consumer pockets and the inflation outlook. The oil price seems to have settled around $50. Prices are not likely to rise back to 2014 levels as Saudi Arabia remains intent on keeping prices low in order to shake out high cost producers. This hasn’t had a big impact yet and with Iranian oil production hitting the market for the first time since 1995 and Iraq upping production. There is a cap on prices rising. Overall this is positive for global consumers and keeps inflation in check allowing policymakers to keep rates low.

Against this background we don’t feel the need to rush into buying more resource exposure at present, as the catalyst to unlock value is still difficult to identify at this stage. We will, however, continue to monitor the macro-environment, in particular central bank policies, global currency markets and Chinese industrial growth, in order to identify any catalysts that will awake the commodity bull out of its long slumber.